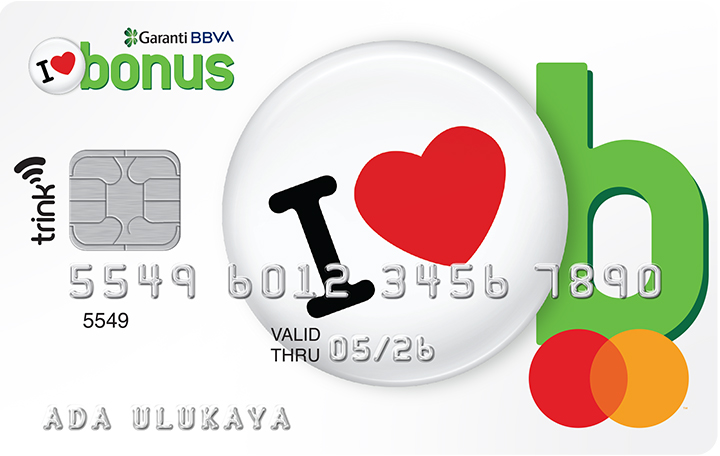

The most loved, used, and rewarding!

With Bonus, which introduced Turkey to the concept of bonus, you can purchase in installments, earn bonuses and enjoy free shopping as you use your card!

Accepted everywhere across the world, Bonus now takes care of all your needs and more.

Moreover, thanks to the contactless Tap & Go feature of your Bonus , you can carry out your transactions up to 750 TL without needing the PIN or signature at every location with a Mastercard™ PayPass® POS terminal. To use this feature, you just need to tap your card to the POS terminal after the purchase amount has been entered into the device. Your transaction will be completed in less than a second.

If you wish, you may also apply via Garanti BBVA Mobile, Garanti BBVA Internet Banking, 444 0 333 Garanti BBVA Customer Communication Center, or our branches.

BonusFlaş allows you to take control of your Bonus card details, payments, and campaigns in a single application. Install BonusFlaş now!

Features

- You earn bonus on all purchases across the world.

- You earn more bonuses on purchases from thousands of Bonus Program Partners.

- You can use your accumulated bonuses to shop for free at Bonus program partners.

- You can combine the pleasure of bonus with the comfort of purchases in installments.

- With your Bonus, you can access your current accounts from all Garanti BBVA ATMs and conveniently perform the transactions that you carry out with your Paracard, such as money withdrawal and depositing.

- When you need cash, you can withdraw cash advances with fixed installments and suitable interest rates.

- You can find out about your accumulated bonuses through Bonus program partners, Garanti BBVA Mobile, Garanti BBVA Internet Banking, 444 0 333 Garanti BBVA Customer Communication Center, bonus.com.tr, or your account statement.

- You can easily and quickly make your payments via Garanti BBVA Mobile, Garanti BBVA Internet Banking, or 444 0 333 Garanti BBVA Customer Communication Center.

- Bonus enables you to perform your contactless transactions up to 750 TL without a PIN or signature. However, you are required to enter your PIN for transactions over 750 TL.

Rates and Fees

Last update: -KKDF (Resource Utilization Support Fund) and BSMV (Banking and Insurance Transactions Tax), collected in accordance with the law, are 15% and 15% respectively.

* No annual membership fee is charged for the first year.

** The shopping interest is the interest rate that will be applied to your remaining period balance. The overdue interest is the maximum net monthly interest rate determined by TCMB that will be applied only to the unpaid portion of your minimum payment amount if you pay less than the minimum payment amount of your period balance.

*** For one time only, you can replace your existing card with a Transparent or Reflected Bonus by paying TL 24,5.

Security

Why are transactions with a contactless credit card safe?

- While creating methods that monitor, predict, and prevent fraud cases, Garanti BBVA and MasterCard develop very advanced fraud prevention techniques to ensure that you will be least affected in such cases. With secure coding technology, your contactless Bonus is as secure as your usual credit card.

- You are in control! - Your Bonus cannot make a payment unless you request otherwise.

- No accidental payments - Your Bonus must be placed within a distance less than 10 cm from the reader device for a payment transaction to be executed.

- No double payments - Even if you scan your Bonus card to the reader more than once during the payment, you only pay once.

PayPass Technology

- The Bonus card has a contactless chip and radio frequency transmitter. During the payment, when you approximate your Bonus to the reader, payment details are transmitted to the MasterCard network. You get the payment approval soon after you hear the beep sound.

Security Advice

- If you are worried about protecting your credit card information, just follow a few simple steps to relieve yourself of this stress.

- Stolen cards are mostly used within the first 48 hours. If you notice a suspicious transaction performed with your card, do not use your Bonus, and do call the Customer Communication Center at 444 0 333 immediately and inform the bank of the suspicious transaction by following step 1.

- Make sure you know where your Bonus is, and keep it somewhere safe.

- Check frequently that not only your Bonus card but also your other credit cards are with you in order to make sure that they are not lost.

- Create a single list including the following information about all your cards: card number, expiry date, and emergency number written on the back. Keep this list in a safe place, separated from your cards. You can use the information on this list if you lose your card or it gets stolen.