Search History

Popular Searches

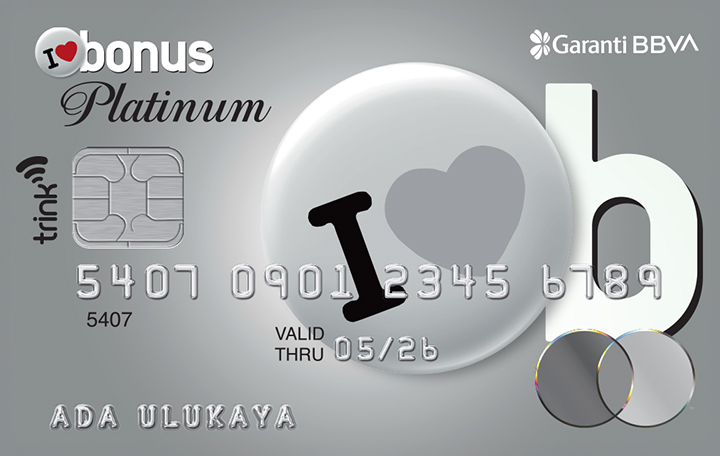

Enjoy being privileged everywhere with Bonus Platinum!

Bonus Platinum, the most prestigious of Bonus! You can earn up to 7,500 TL monthly bonuses from your purchases with Bonus Platinum.

Features

- Start earning Extra Bonuses with Bonus Platinum!

- With the Extra Bonus feature of Bonus Platinum, you start earning 50% more bonuses on all monthly purchases over 2,000 TL and 100% more bonuses over 4,000 TL. *

- For your monthly 750 TL and over e-commerce purchases, you earn a %5 bonus. **

- What’s more, for your monthly 500 TL and over restaurant spends, you earn 50 TL bonus.

- 5.000 TL and over cross border spendings, you earn 250 TL bonus.

- Bonus Platinum has all the same features of Bonus when it comes to rewards. With Bonus Platinum, you can choose to pay in installments when you shop at thousands of Bonus Program Partners, and you can earn bonuses on your purchases and use your earned bonuses for free shopping whenever you want.

- Bonus Platinum enables you to perform your contactless transactions up to 750 TL without a PIN or signature. However, you are required to enter your PIN for transactions over 750 TL.

- For your Bonus Platinum card debt payments, you can use Garanti BBVA Internet Banking, 444 0 333 Garanti BBVA Customer Communication Center, or BonusFlaş.

- BonusFlaş allows you to take control of your Bonus Platinum card details, payments, and campaigns in a single application. Install BonusFlaş now!

*The maximum monthly extra bonus amount is limited to 20 TL and yearly to 150 TL.

**The maximum monthly extra bonus amount is limited to 42 TL and yearly to 500 TL.- Start earning Extra Bonuses with Bonus Platinum!

Rates and Fees

Last update: -